Weather Market Fluctuations

Alternative risk transfer solutions to manage agricultural price volatility

10+

Crops CoveredBuilding Resilience: The Vital Role of Price Management in Agriculture

Managing price volatility is crucial for farmers and

agribusinesses across the food supply chain. For farmers, sharp

price swings can mean the difference between profit and financial

strain, making investing in essential inputs like seeds,

equipment, and labor challenging. For agribusinesses, it’s about

protecting thin margins, as unstable prices disrupt supply

consistency and consumer pricing, risking shortages and lost

sales. Agri-lenders, too, cite price volatility as a key

challenge, as fluctuating incomes increase the risk of loan

defaults.

Yet, solutions to manage price risk are limited. Commodity

derivatives, while helpful, cover only a few major crops and

markets, leaving many in agriculture exposed. That’s where Agtuall

steps in. Our innovative price insurance solutions provide

stability for farmers, agribusinesses, and financiers alike,

supporting secure revenue streams and facilitating access to

financing—all essential for a resilient agricultural sector.

Discover how Agtuall’s approach is redefining risk management for

agriculture.

Price risk protection provides stability and confidence

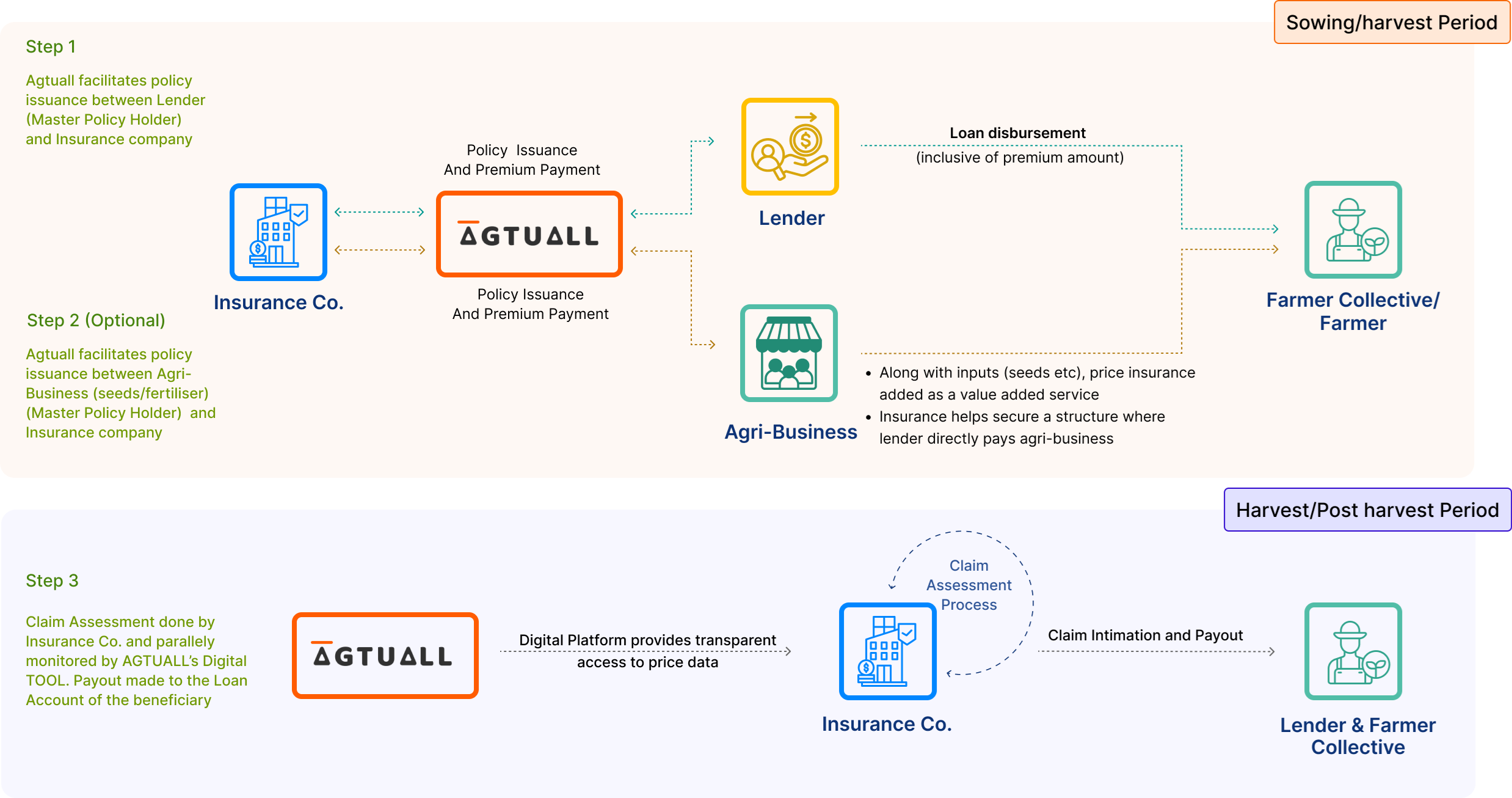

Typical Workflow

Scenarios

The following scenarios illustrate how this ecosystem approach benefits various value chain partners

- Who: Borrowers are the claim beneficiaries.

- Why: This tailored insurance solution reduces transaction risk for both the financier and the agri-input provider.

- How: The input provider includes insurance as an optional service, adaptable to farmers’ needs, adding security and flexibility to the financing model.

- Who: Growers requiring post-harvest finance are the beneficiaries.

- Why: Custom price protection helps farmers avoid distress sales and capture potential future price increases.

- How: Insurance covers the difference if prices drop during the sale period, ensuring a minimum price and empowering farmers to achieve better returns.

- Who: The lender is the claim beneficiary.

- Why: A customized portfolio-level insurance policy protects against credit risk from price fluctuations.

- How: Coverage is tailored to specific commodities or spans a diversified portfolio, making risk management scalable for lenders.

- Who: Farmer groups or aggregators are the beneficiaries.

- Why: With custom price protection, growers can offer guaranteed prices, stabilizing their income without bearing all the risk.

- How: Insurance is embedded within the off-taker agreement, tailored to crop and market conditions, ensuring secure pricing for growers and stable supply for off-takers.

Case Studies

Frequently asked questions.

There are two main options we offer: pre-harvest and post-harvest price insurance.

- Pre-harvest: You choose a price level (strike price) to insure your crop for before planting or during the growing season.

- Post-harvest: You lock in a price after harvest, ideal if you anticipate price declines.

In both options, market prices are tracked by a reliable third-party source. If the average market price during a predefined period (e.g., harvest month) falls below your chosen strike price, a payout is automatically triggered based on the difference. No claim filing is necessary.

The premium you pay will depend on several factors, including:

- The crop you're insuring

- The chosen strike price (higher strike prices generally lead to lower premiums)

- The historical price volatility of the crop

- The coverage level you select (percentage of the crop value insured)

- For pre-harvest insurance, factors like planting date and historical yield data may also be considered.

Since this is a parametric product, the payout process is automatic. Once the predefined period ends and the market price data is verified, the payout will be electronically deposited directly into your designated account, assuming the market price falls below your strike price.